unemployment tax refund update september 2021

From my knowledge this means that theyve audited my account and I dont owe anything. 1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true.

2022 Tax Refund Update How You Can Get A 5 000 Stimulus Check 19fortyfive

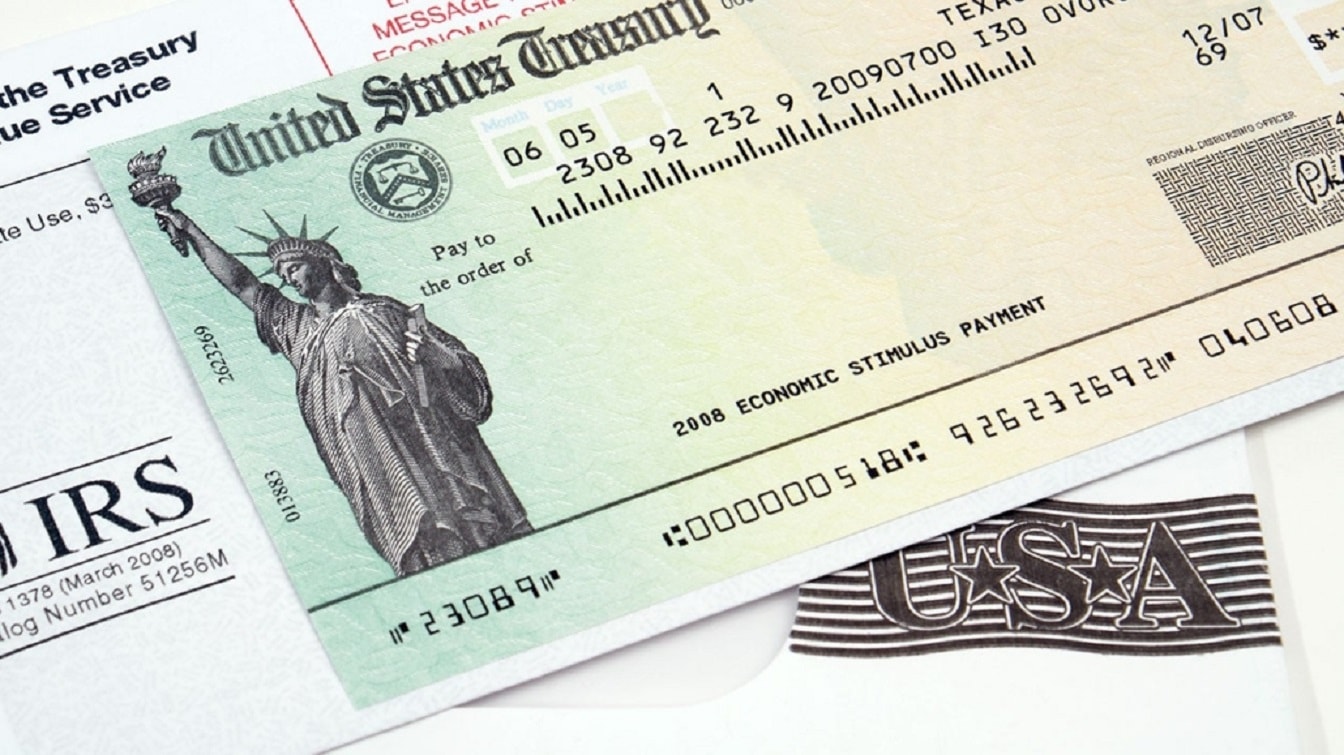

The IRS reported that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust taxable income amounts based on the exclusion for unemployment compensation from previously filed income tax returns.

/cloudfront-us-east-1.images.arcpublishing.com/gray/TWLAHS3UMZCJ7BZ553JPXH4WAA.png)

. Hello so I looked at my IRS account transcript and noticed that theres a tax code 290 reading Additional tax assessed with a date of 7-26-2021. The unemployment tax refunds are determined by the employees earnings the length of time on unemployment and the states maximum benefit amount. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020This tax break was applicable for.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. Irs Sending Out 4 Million More Tax Refunds To Those Who Overpaid On Unemployment.

You did not get the unemployment exclusion on the 2020 tax return that you filed. That number can be as much as 20400 for Married Filing Jointly taxpayers if each received benefits. 117-2 on March 11 2021 with respect to the 2020 tax year.

IR-2021-212 November 1 2021. 23 states including Florida to end the 300 unemployment boost. More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming.

Child Tax Credit Updates. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. By that date some taxpayers had already filed 2020 tax returns including the unemployment benefits or did so afterward.

To find out if you are included in this phase of unemployment refunds. The unemployment exclusion was enacted as part of the American Rescue Plan Act PL. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. The next phase of unemployment refunds will be issued on Wednesday August 18th. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020.

You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7. Unemployment Tax refund. IRS Unemployment Tax Refund 10 September 2021 IRS unemployment tax refund 2021.

More than 87 million unemployment compensation refunds have been issued by the IRS totaling more than 10 billion as per MARCA. 2021 Tax refund delays continue as millions of tax payers tax returns held for manual processing. In the latest batch of refunds announced in November however the average was 1189.

The unemployment refund is a refund for those that overpaid taxes on their 2020 unemployment. September 18 2021. Unemployment Income Rules for Tax Year 2021.

Your state or federal income tax refunds may be garnished to satisfy any money owed you can be denied unemployment benefits in the future you must repay the benefits you received plus interest and penalties. Unemployment tax break refund update september 2021. Unemployment tax break refund update september 2021.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American. The 300 unemployment boost from the American Rescue Plan is to end early September however many states are choosing to end the unemployment benefits early because of a worker shortage.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13.

Heres what to know about paying taxes on unemployment benefits in tax year 2021 the return youll file in 2022. Report fraud If you suspect someone is illegally collecting unemployment benefits or committing fraud you can report it online. TAS Tax Tip.

How To Obtain My W2 From Unemployment. 117-2 on March 11 2021 with respect to the 2020 tax year. Anyways I still havent received my unemployment tax refund and there.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. Taxpayers who submitted their taxes before March 20 2021 are now entitled to an adjustment and perhaps a refund. So far 87 million have been identified and this number is only going to go higher.

The IRS efforts to correct unemployment compensation overpayments will help most of the affected. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. IR-2021-159 July 28 2021.

Waiting for your unemployment tax refund about 436000 returns are stuck in the irs system. Unemployment tax refunds started landing in bank accounts in May and ran through the summer as the IRS processed the returns. Hello and welcome to our live blog on Saturday 4 September 2021 providing you with the latest updates on a potential fourth stimulus check and information on the expanded Child Tax Credit a.

We know these refunds are important to those taxpayers who have.

Tax Refund Delays Reasons Why Your Irs Money Hasn T Arrived Yet Cnet

Tax Refund Timeline Here S When To Expect Yours

Average Tax Refund Up 11 In 2021

Irs To Send Out Another 1 5 Million Surprise Tax Refunds This Week Wgn Tv

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

14 4 Billion Worth Of Tax Refunds Finally Given To Eligible Taxpayers Irs To Distribute 1 600 Refunds Each Before The Year Ends The Republic Monitor

Confused About Unemployment Tax Refund Question In Comments R Irs

How Long Will It Take To Get Your Tax Refund Here S How To Track Your Money Cnet

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Tax Day 2021 Child Tax Credit Other Changes